Content overview: From the perspective of the domestic service robot market, affected by the COVID-19 pandemic in 2020, the service robot has found new chance, and the anti -epidemic series robots have formed an industrial growth point that has begun to take shape. According to statistics, from 2018-2022, our country’s service robot market is dominated from household service robots, and gradually transformed to commercial service robots occupying the upper hand. The market size has increased from 11.78 billion yuan to 40 billion yuan. Demand in public services and education has become the main driving force for the development of service robots.

Keywords: service robot industry chain, service robot policy, service robot market size, service robot market structure, service robot trend

- Overview of the service robot industry

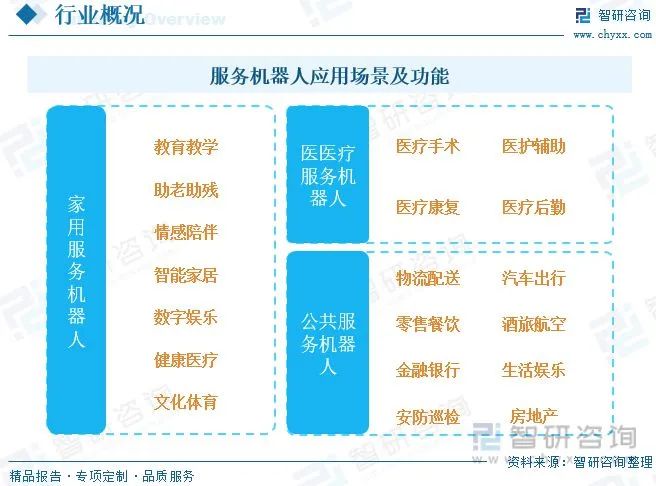

According to the definition of the International Robotics Alliance, service robots are a semi -autonomous or fully autonomous robot. It can complete service that good to human health, but does not include equipment engaged in production. The positioning of service robots is service. From the perspective of the functional characteristics of the robot, a essential difference between it and an industrial robot is that the working environment of industrial robots is known, and most of the working environment faced by service robots is unknown. The service robot application scenarios are complex and diverse, and there are many types of specific subdivision. It can be applied to many industries and scenarios such as retail, logistics, medical care, education, security, etc., to achieve diversified and compound functions such as guiding reception, logistics distribution, cleaning, accompanying teaching, and security inspection.

- Related policies for China Service Robot Industry

In recent years, in order to promote the development of the service robot industry, my country’s government and relevant departments have introduced a series of policies to encourage the development of the service robot industry. With the strong support of government policies, my country’s robotics industry has made great progress; on January 1, 2022, the “Regional Comprehensive Economic Partnership Agreement” (referred to as “RCEP”) officially took effect. 15 countries and regions such as Australia and New Zealand mainly reduced the cross -border trade costs between member states through the means of deducting tariffs and exemptions, promoted the import and export of robots and related parts, and to a certain extent, which improved the robot products of my country’s robotics to a certain extent. quality. In 2023, as RCEP further implements the promise of opening up the agreement in all aspects, policy dividends will continue to be released. The intelligent manufacturing industry represented by robots in China will usher in a high -speed development stage. Related policies in the Chinese service robot industry are as follows:

- Service Robot Industry Chain

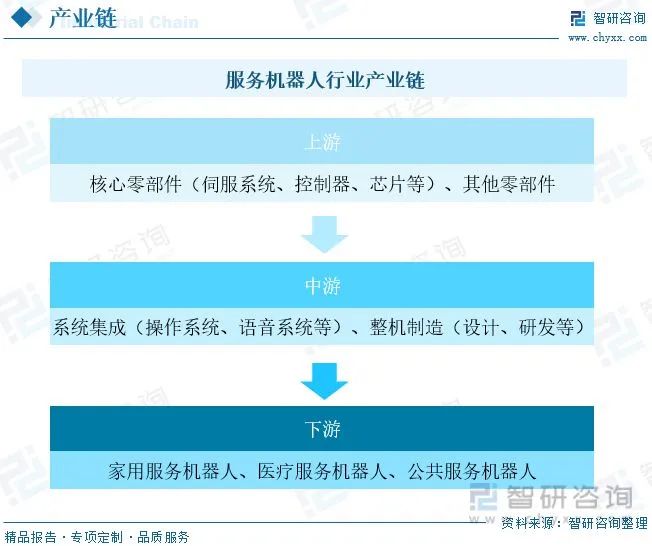

The upper reaches of the service robot industry chain consists of components such as chips, servo systems, controllers, sensors, reducers and other components and machine vision, voice recognition and other system integration. The midstream of the service robot industry chain is manufactured for home service robots, medical service robots, and public service robots. The downstream applications in the service robot industry chain mainly include: catering, hotels, medical care, pension, housekeeping, fire protection, logistics, etc.

In 2021, the domestic chip market size was about 186.5 billion US dollars, while the chips produced in mainland China were only 31.2 billion US dollars, with a self -sufficient rate of about 16.7%. As of 2022, the size of my country’s chip market has increased to 192.5 billion US dollars. It is expected that the size of the Chinese chip market in 2026 will reach US $ 274 billion. The value of chips produced in mainland China will be 58.2 billion US dollars, accounting for about 21.2%. In the servo market, all suppliers have a clear market positioning. The size of the Chinese servo motor market rose from 11.6 billion yuan in 2017 to 18.1 billion yuan in 2022. With the further intensification of China’s population aging, the demographic dividend has gradually faded, and the cost of labor has increased year by year. The demand for automated production line equipment, especially manufacturing, will always maintain a growth trend.

Related reports: “2023-2029 China Service Robot Industry Development Strategic Planning and Investment Opportunities Forecast Report” released by Zhiyan Consultation

- Analysis of the development status of the service robot industry

Robots have huge development potential worldwide, and the development of service robots in developed countries has a broad market. In Japan, North America and Europe, more than 40 service robots have been included in experiments and semi -commercial applications. A few days ago, the United States is committed to converting technologies such as robotics and small unmanned reconnaissance helicopters developed for the army wounded staff into civilian use. The European Union launched civil robot research and development projects and invested 2.8 billion euros for research and development for medical care, care, housework, agriculture and transportation Robots in areas. In the field of service robots, in the top countries, Western countries are represented by the United States, Germany and France, and Asia represented by Japan and South Korea. According to statistics, as of 2022, the global service robot market size was approximately $ 15.55 billion, of which the household service robot market accounted for the highest proportion.

With the rapid development of service robots, it has achieved rapid development in various fields of economic and social development in medical rehabilitation, education and entertainment, housekeeping services, rescue disaster relief, public services, commercial applications, national defense, etc. The application of countries around the world attaches great importance to the development of service robots, and provides its key support for strategic emerging industries, which has its important strategic significance. From the perspective of the domestic service robot market, affected by the new crown pneumonia’s epidemic in 2020, the service robot has found a new machine, and the anti -epidemic series robots have formed an industrial growth point that has begun to take shape. According to statistics, from 2018-2022, my country’s service robot market is dominated from household service robots, and gradually transformed to commercial service robots occupying the upper hand. The market size has increased from 11.78 billion yuan to 40 billion yuan. The main driving force for service robot development.

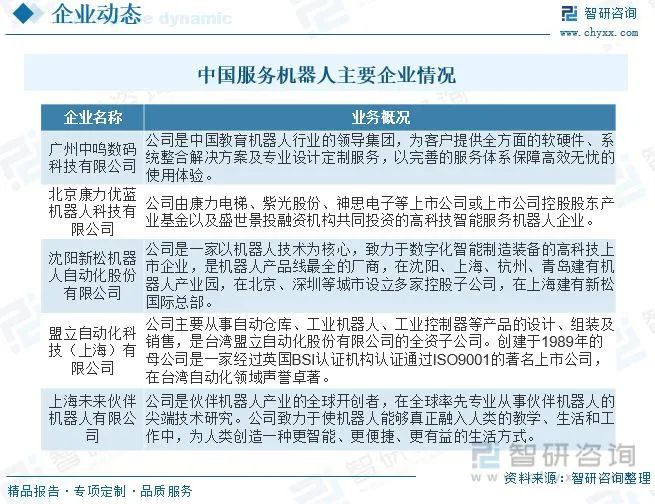

- China’s service robot industry key enterprises。

At present, the domestic service robot industry has a high market concentration, there are many competitors, the competition is more fierce, and the focus of the brand head in the industry is relatively obvious. The domestic head enterprise industry has a wide range of industries, actively developing a global strategy, and has strong competitiveness in the international market competition. my country’s service robot manufacturing enterprises are not limited to technology companies and large Internet companies, but many home appliance companies have also entered the service robot industry. Essence The entry of home appliance companies has injected new energy into the service robot industry and exacerbated industry competition.

- The development trend of China’s service robot industry

The intelligent service robot has a long industry chain, strong driving, and radiation, and is still in the stage of decentralized development worldwide. Strengthening the core technology and products of service robots is of great significance for major national needs and security, and improving people’s livelihood. Strengthening the research and development of frontier technology, core components and related standards for service robots. It has an important promotional role; strengthening the exploration of robot perception, decision -making, and implementation has an important promotional role in the upgrading of traditional industries.

Our country has closely focused on the transformation and upgrading of the national economy, the growing demand for the people’s growing life, and the major national strategic needs. While continuing to achieve the foundation of the service robot industry, strengthen the forward -looking layout, accelerate the breakthrough of the core key technologies of the service robot, and take corresponding measures in the aspects of service robot innovation ability, the construction of standard testing and certification system, and talent training to ensure the rapid development of our service robot industry.

For more in -depth research and comprehensive data of the service robot industry, please pay attention to the official website of Zhiyan Consultation or public account (Zhiyan Consultation),You can also check ”2023-2029 China Service Robot Industry Development Strategic Planning and Investment Opportunities Forecast Report” released by Zhiyan Consultation

This “Report” starts from the perspective of the development environment of the national service robot industry, overall operational trend, operation status, import and export, and competitive pattern in 2022. Systems and objectively analyzed the development and operation of the service robot industry in my country. The development trend of China’s service robot industry. The “Report” is a book that systematically analyzes the development of the Chinese service robot industry in 2022. It has important reference value for comprehensively understanding the development status of the Chinese service robot industry and the development of academic research related to the development of the service robot industry. Reading reference for relevant personnel, scientific research institutions, industrial enterprises and other relevant personnel in the service robot industry read reference.

Special statement: The above content (if there are pictures or videos, including it), uploaded and published by the self -media platform “Netease” users. This platform only provides information storage services.

Post time: Aug-04-2023